The following article is an opinion piece and solely the personal opinion of the author. It should be read strictly as opinion and not as a blanket statement of fact.

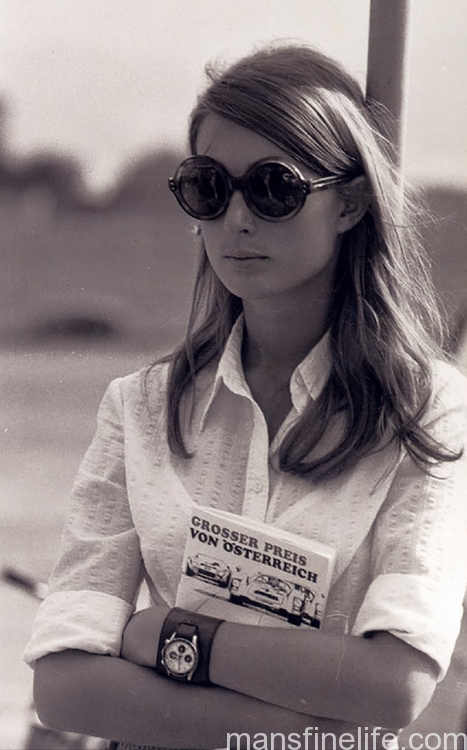

This is a story about Nina Rindt, or more precisely the vintage watch that was named after her: a smallish, panda-dialed Universal Geneve 3-register “Compax” chronograph from the 1960s. And it’s about what this collectible chrono’s meteoric ascent tells us about how markets for vintage watches are made these days. The Valjoux 72-powered “Nina” was so dubbed by collectors because of pictures showing the wife of legendary Formula 1 driver Jochen Rindt wearing her UG chronograph at various racing events in the 1960s through the fateful year of 1970, when Jochen was killed at Monza and went on to become the first and only posthumous Formula 1 champion. Jochen Rindt also has a watch named in his honor because of his personal association with it, the Heuer Autavia 2446 with screw back. As with so many great vintage pieces, “branding” vintage watches with a celebrity’s name is nothing new. It certainly worked magic with the Paul Newman Daytona and its market value. So ever since, savvy dealers have been looking for links to the famous when selling their watches, often with mixed results (see the “Steve McQueen” Rolex 1655 Explorer II, a watch McQueen never actually wore).

Header photo via Yorktime.com; Nina Rindt photo unknown

The earliest reference I can find to the “Nina Rindt” nickname for the panda UG Compax is from back in 2012 in a Chronotrader ad. But it’s probably safe to say the term had been kicking around at least since shortly after this 2006 post on the main On The Dash Heuer Forum. OK, so we have a catchy nickname and established celebrity provenance. And we also have a genuinely uncommon watch, one that you are simply not going to see in most second hand watch stores or even find on eBay too often. Now what? Well, after a few years of steady increase, the “Nina” gradually rose to around an $8000 dollar watch as of the end of 2013. Which is not too shabby and probably a quadrupling of value in about 4 years give or take. I think this is well within the level of standard appreciation in the timeline of a desirable model getting more well known, talked about, shown on the internet and eventually having “Grail” status bestowed upon it by collectors of that specific brand or type of watch.

And then things got really nutty. In early 2014, watch enthusiast site extraordinaire Hodinkee published one of their ubiquitous “Found” articles on a very nice “Nina” with a lot of backstory on the watch and the entertaining account of the owner’s acquisition of it. Now blessed with Hodinkee’s unparalleled reach as the arbiter of what is hot and sexy in the vintage watch world, the “Nina” really took off. The other enthusiast/industry fluffing sites caught on and so, of course, did the collector forums, who are no dopes either. By the time Hodinkee made another mention of a nice “Nina” for sale in October of that year on their dealer booster feature, “Bring a Loupe”, the “Nina” had blown up to around $15k during the course of that red hot summer and early fall. But we still hadn’t seen anything yet.

Here’s how things went from October 2014 on from the horse’s mouth, a then-Hodinkee contributor:

“…recent transactions that we have record of for the Nina Rindts:

Last October [2014], one reportedly sold for $23,000 in a silent auction by analog/shift that I wrote about on HODINKEE.

https://www.hodinkee.com/blog/whats-selling-where-five-absolutely-killer-watches-begging

Then Yorktime in Canada reportedly sold one for $19,000 within the weekend after I wrote about it on HODINKEE [January 2015]:

https://www.hodinkee.com/blog/whats…net-jackson-to-her-lover-and-a-watch-to-avoid

Then Matt Bain reportedly sold one for $22,000 within a couple days after I featured it on HODINKEE [March 2015]:

https://www.hodinkee.com/blog/from-a-lecoultre-deep-sea-alarm-on-ebay-to-a-crazy-vintage-b“

The Hodinkee – Analog/Shift “Nina” that lit the fuse (Photo via Analog/Shift)

Let’s unpack this a little bit, shall we? So we have the Analog/Shift “Nina” — presumably the same example highlighted in that earlier “Found” installment — being sold at silent auction for a reported $23k. That is a jump in market value of about $7-8k right there and now we are suddenly into the stratosphere of Rolex Daytona money. And the silent auction format is a beautiful thing because no one knows what the second best bid was (except for Analog/Shift, I assume) or if it was even close to that $23K number. It might have only been $17k but who knows? And anyway who cares because now there is a new benchmark, self-referenced by Hodinkee again early in 2015 when they link watch being sold by long time dealer and all around good guy Rod Cleaver of Yorktime.com in Canada. This one, “only” priced at $19k, sells directly after it’s highlighted by them. And then in March, they follow that up with a shout out to their longtime friend and big time vintage dealer Matt Bain… and that watch is snapped up for a reported $22k in short order.

So now we have absolutely got an established price point for the UG “Nina” Compax and it is $20k or higher. Wow that was fast! But this is how it can happen in this Internet and Instagram-driven era, where the pool of potential buyers for something cool, chic and rare is growing exponentially and for a certain kind of guy (and sometimes lady), there is nothing quite as cool and chic as a rare vintage watch. The sexy pictures, glowing reviews and that little bit of magic history can really make a specific vintage model soar to unprecedented new heights. Just witness what happened to vintage Heuer models with authentic F1 connections in the past 5 years. And just look at what’s happening now with Enicar “Sherpa” chronographs from the 1960s, a onetime true budget collectible, after confirmation that an early model was once worn by racing great Jim Clark. It can happen just that fast. Now I understand the feeling those old time watch guys have when they wax rhapsodic about $5k Double Red Red Sea-Dwellers and $8k Paul Newmans.

But to paraphrase Buffalo Springfield, there is also something else happening here. These market forces are not happening in an entirely organic vacuum. Just look at the price sequence for the “Nina”, which I have chosen specifically because it is so informative of the way markets are actually being made in the watch world right now. Hodinkee “discovers” the Nina Rindt UG Chrono for a much wider audience, taking a sort of specialized, cult, inside baseball model to instant mainstream “Grail” status among people who never heard of it before. This provokes rivals within the savvy watch website/blog industry to write about its rise in those plentiful “watch market” reports. After a steady summer of near-frenzied interest, Hodinkee begins linking examples of the “Nina” that their dealer friends are offering. And very quickly that frenzy that they have helped create explodes into record prices.

I think it’s all very clever if not a little bit incestuous. But that seems to me the true purpose of Hodinkee and the other really polished “enthusiast” sites. They may present themselves as helping the aspiring collector to know what is up and coming and cool and fashionable. But what they are really doing, in my opinion, is linking to dealers and auction houses and using their reach and influence to buoy the prices of the pieces that they are flogging at that particular moment for the benefit of the professionals in this business. There is perhaps a “finder’s fee” involved for the company after a confirmed sale — heck, there ought to be with the amount of revenue they generate for others. I know I’d want something in return for my efforts if I were a company engaged in that sort of promotional work. But either way there is likely some business relationship happening there that leads to the watches being featured and/or something remunerative if they are sold via that exposure. And even if there’s no actual financial benefit to the company, at the very least this sort of drumbeat of publicity and highlighting of different models serves to keep the vintage market nice and frothy for those who view watches more as an investment than a hobby, as well as the sellers of these timepieces. You could call it the “Hodinkee effect” and if you’re a collector you’d be wise to keep track of where it’s heading next.

And there’s nothing inherently wrong with all of that at all. You can argue that it’s capitalism at its finest, a sort of publicity arm serving the industry in a very interconnected if never overtly stated way. In fact, the aforementioned “Nina” writer went from writing for Hodinkee to a VP position at Christie’s auction house (and obviously Hodinkee is more than happy to report on and highlight upcoming Christie’s watch auctions). Another went from Hodinkee to Bloomberg, where he writes about watches and, guess what, links back to Analog/Shift, Matt Bain, etc. So the interconnected nature of the big time sellers of watches and the professional “enthusiast” blogs is really quite clear if you look closely. Long story short, these guys are all very bright and many have MBA’s so if you think they are linking to random sales because they are just jazzed about watches that is a pretty naive take in my opinion. Heck, they even regularly link to eBay auctions that might fly under the radar, which drives the prices up there, too. But then, as we’ve seen with the major watch brands (looking at you, Patek Phillipe and Omega) the big marques in fact regularly bid on their own watches at major auctions to keep the prices high on the secondary market. So one can’t say there’s anything wrong with this very hand-in-glove collaboration and market making and you can look to see more of this sort of “synergy” in future, not less, so long as people are willing to spend the money for these timepieces. With the instant gratification of the internet, the eye candy of Instagram and sophisticated sites like Hodinkee telling you not only what’s cool now but where to find it, albeit at premium prices, the sky’s the limit for models and brands to hype and bring to a new level. And with the hedge fund guys already looking at high end vintage watches as a market to be exploited, watch out.

In fact, it looks like the UG Tri-Compax is next on the list, having gone from around a $6k watch to well over $10k over the course of this short summer — much to my surprise! — no doubt riding Nina’s coattails. Ironically, these sorts of dramatic increases are aided and abetted by the brands’ loyal longtime followers who feel that their marque is the one that should be getting the praise and attention that, say, a Rolex Daytona gets, even if it winds up freezing them out of future purchases of their favorite brand. My next bet would be that the “lesser” models of classic Universal Geneve like the Polerouter, their interesting divers and other non-chrono models also start getting a boost from all this heat. And then perhaps there will be a well-publicized and well-curated “theme” auction at one of the big houses for Universal Geneve timepieces and we’ll see them achieve even greater heights. And then… well, that’s the unknown. For Patek and sometimes Rolex, the big vintage auction results tend to be the new benchmark price. But even Rolex saw a decline after the frenzy of 2008’s Revolution at Antiquorum and the subsequent housing bubble-induced recession. And of course most of us look back at AQ’s Omegamania in 2007 and generally feel that there was too much effort to make a market happening there and that those were extremely flukey results that even today have not been replicated (poor old Omega!). Same goes for the recent much ballyhooed Christie’s “Lesson One” Daytona auction — at least as far as common Daytonas go there was no huge uptick. The future of the market is always unknown, although generally the track record for vintage watches is pretty good in a steadily increasing sort of way. But sometimes the farther and higher something flies, particularly if there’s a somewhat artificial tail wind, the faster it crashes and burns.

Like I said, there’s nothing wrong or untoward about any of this in my opinion. It’s just the evolution of a once-niche market into a high tech financial venture to be exploited with a lot of help from various industry players and insiders with a stake in the action, plus a lot of willing participants looking to spend their money on a very cool collectible vintage watch where finding the absolute best price is not their main concern. But you should have an idea of how it works and what could be happening behind the curtain before you decide to jump in at the top of the market and spend your hard earned cash. As a fellow collector, that seems only fair to me. So my advice, as always, is to to buy what you like and don’t necessarily follow the latest breathless hype. Chances are if you’ve got good taste, the watches you acquire will have their day in the sun too.